AI has permeated various sectors, and banking is no exception. With its potential to enhance efficiency, security, and customer satisfaction, AI is a game-changer for financial services. Its use in banking is not just a fleeting trend; it represents a fundamental shift in how banks operate and interact with their customers.

This article delves into the role of AI in banking, exploring its key applications, discussing the driving factors behind its adoption, and addressing the associated challenges. We will also look at some successful implementations of AI in banking and provide a glimpse into the future of this exciting convergence of technology and finance.

Whether you’re a banking professional looking to understand how AI can benefit your organization or simply an AI enthusiast keen on understanding its impact on the industry, this comprehensive guide is for you.

AI in Banking: Key Concepts and Applications

AI in banking refers to the use of machine learning algorithms and software, or “bots,” to replicate human intelligence in the analysis, interpretation, and understanding of complex data in the banking industry.

This technology can perform tasks that normally require human intelligence, such as learning, decision-making, problem-solving, understanding language, and recognizing patterns.

The adoption of AI in the banking industry is driven by a number of factors:

Data Volume

Banks manage an enormous volume of data every day, including transaction details, customer information, market trends, and more. The sheer size and complexity of this data present a significant challenge for manual analysis and processing.

However, AI, with its advanced machine learning algorithms and data analytics capabilities, can effectively handle this data deluge. It can sift through millions of data points in seconds and identify patterns, anomalies, and valuable insights that are not immediately apparent to human analysts.

Customer Expectations

In this digital age, customer expectations in the banking sector have dramatically evolved. Customers now demand services that are not only efficient and secure but also personalized to their unique needs and preferences. AI plays a pivotal role in meeting these expectations by harnessing the power of data to provide personalized financial solutions.

Financial crime prevention

Financial crime, including fraud and money laundering, poses a significant threat to the banking industry. Traditional methods of detecting such activities are often insufficient due to the increasingly sophisticated tactics criminals employ.

AI, with its advanced pattern recognition and predictive capabilities, provides a powerful solution to this issue. AI algorithms can sift through vast amounts of transactional data in real-time and identify unusual patterns and behaviors that could indicate fraudulent activities.

Regulatory Compliance

Regulatory compliance in the banking sector has become increasingly complex, with ever-changing rules and standards. Failure to comply can result in hefty fines, reputational damage, and loss of customer trust. Traditional, manual methods of ensuring compliance are time-consuming, costly, and prone to human error.

AI, however, offers a transformative solution to this challenge. AI-powered tools can automate many compliance tasks, such as monitoring transactions for suspicious activity, conducting customer due diligence, and preparing regulatory reports.

Applications of AI in Banking

AI has a wide range of applications within the banking and financial services industry. Here are some notable examples:

Fraud Detection

AI-powered systems can analyze vast transaction data in real-time to identify suspicious activities and potential fraud. By recognizing patterns and anomalies, they can flag transactions for further investigation or block them entirely, helping to protect both banks and their customers from financial loss.

Risk Management

AI algorithms can assess risk levels for various banking services, such as loans, credit, and investments. By analyzing data from multiple sources, AI can provide banks with more accurate risk assessments to make informed decisions about lending, investing, or setting interest rates.

Improved Customer Service

AI plays a significant role in enhancing customer service within the banking industry. Chatbots and virtual assistants, powered by AI, can provide 24/7 support to customers, answer queries, and resolve issues quickly and efficiently.

AI can also help banks offer personalized financial products and services by analyzing customer data to identify individual preferences and financial behaviors.

Operational Efficiency

AI significantly enhances banking operations by automating repetitive tasks and optimizing workflows. This leads to increased productivity, cost savings, and improved customer service.

For instance, AI can predict peak customer service times for better resource allocation and streamline loan approval processes with improved credit scoring models, reducing wait times and enhancing service accuracy.

AI-Powered Fraud Detection and Risk Management

AI has become a crucial tool in the banking sector for detecting fraud and managing risk.

By applying machine learning algorithms and advanced data analytics, it can scrutinize vast amounts of transaction data in real-time to identify irregular patterns, anomalies, or suspicious behaviors that might indicate fraudulent activity.

For example, AI systems can be programmed to recognize specific patterns associated with fraudulent transactions, such as sudden large withdrawals, frequent transfers in a short timeframe, or transactions from locations unusual for the customer.

When such patterns are detected, the system can automatically alert the bank and the customer, allowing for immediate action to prevent potential fraud.

Risk management in banking is another area significantly improved by AI. AI can analyze complex market data and trends to predict potential risks, helping banks make more informed decisions regarding investments and loan approvals. It can also identify customers more likely to default on loans, reducing the risk of bad debt.

Moreover, the predictive capabilities of AI in assessing customer behavior patterns can aid banks in identifying potential churn so they can implement proactive measures to improve customer retention. Integrating AI in risk management also supports regulatory compliance by providing more accurate reporting and forecasting.

By leveraging AI in fraud detection and risk management, banks not only enhance their security measures but also improve their decision-making process, customer trust, and operational efficiency. With its help, banks can stay a step ahead of fraudsters, reduce potential losses, and offer a safer banking environment for their customers.

AI Tools for Fraud Detection and Risk Management in Banking

AI technology is the driving force behind several cutting-edge tools and platforms that are enhancing fraud detection and risk management in the banking sector. Here are a few examples:

Feedzai

Feedzai’s software uses machine learning to detect and prevent fraud in real-time. The software analyzes vast amounts of data from multiple sources and uses predictive analytics to identify potentially fraudulent transactions. Feedzai is used by several large banks and payment processors worldwide.

Featurespace

Featurespace’s award-winning ARIC platform uses adaptive behavioral analytics, a form of AI that learns to understand the behavior of individual customers and detect any deviations that may indicate fraud. It is a highly flexible platform used in various industries, including banking.

SAS Detection and Investigation for Banking

This AI-powered solution from SAS provides comprehensive fraud detection, alert management, and advanced analytics capabilities. It can detect a wide range of fraudulent activities, including card fraud, deposit fraud, and enterprise payments fraud.

DataRobot

DataRobot’s enterprise AI platform includes tools for risk management, allowing banks to build predictive models that can assess the risk of loan default, credit risk, and market risk. DataRobot uses automated machine learning, which makes it accessible to non-technical users.

FICO Falcon

The FICO Falcon platform uses machine learning algorithms to analyze cardholder behavior and identify potentially fraudulent transactions. It is a highly effective tool in credit card fraud detection and is used by many of the world’s largest banks.

Ayasdi

Ayasdi’s AI platform provides tools for risk modeling and anti-money laundering. Using advanced machine learning algorithms, it can build highly accurate risk models and detect unusual patterns that may indicate money laundering activities.

These AI platforms and tools are leading the way in fraud detection and risk management, showcasing how technology can enhance security and efficiency in the banking industry. As AI continues to evolve, we can expect to see even more sophisticated solutions in the near future.

Improving Customer Experience with Conversational AI

Conversational AI encompasses messaging applications, speech-oriented assistants, and chatbots to automate interactions and deliver tailor-made customer experiences on a large scale.

In banking and financial services, conversational AI is revolutionizing how institutions interact with their customers, providing a new level of convenience and personalization.

AI-powered chatbots can handle a broad range of customer service interactions, from answering FAQs to assisting with transactions. They can be available 24/7 to respond immediately to customer queries, drastically reducing waiting times.

Additionally, they can handle multiple customer interactions simultaneously, which significantly improves the efficiency of customer service operations.

Advantages of Conversational AI in Customer Service

Integrating conversational AI in customer service within the banking sector brings several benefits:

Availability and Accessibility

AI chatbots are available round-the-clock, enabling customers to receive assistance anytime they need them, regardless of holidays or non-working hours. This significantly enhances customer experience and satisfaction.

Personalized Service

Conversational AI can leverage customer data to provide personalized banking assistance, such as custom product recommendations or financial advice. This personalized interaction fosters a deeper connection between the bank and its customers.

Efficiency and Cost-Effectiveness

AI chatbots can handle several customer queries simultaneously, reducing the need for large customer service teams and lowering operational costs. In addition, they can resolve simple queries, which frees up human agents to handle more complex issues.

Data Insights

Conversational AI tools collect valuable customer interaction data and give banks insights into customer behavior and preferences. This data can be used to further enhance customer service and develop targeted marketing strategies.

Security

Conversational AI also improves security. For instance, voice recognition technology can be used for customer identification, which adds a layer of security to banking transactions.

Successful Implementations of Conversational AI in Banking

With the rise of AI in banking, conversational AI stands out for its ability to revolutionize customer interactions. Here are some examples of how financial institutions have successfully harnessed the power of conversational AI to enhance customer experience and streamline services.

Erica

Bank of America has successfully implemented a conversational AI solution named Erica.

As a virtual financial assistant, it helps customers with various banking tasks, from locating transactions and understanding credit scores to getting bill reminders. It can even provide proactive financial guidance based on customers’ specific needs. As of 2021, Erica had more than 40 million users.

Eno

Capital One’s chatbot, Eno, assists customers with checking account balances, reviewing transactions, and even understanding spending patterns. It can also identify potentially fraudulent activity and alert customers. It is also known for its natural language processing capabilities, which allows it to understand and respond to various customer queries.

Amy

Hong Kong-based HSBC has implemented a conversational AI solution named Amy. Amy is a virtual assistant that offers instant customer support by answering a wide range of banking queries. It is available in English, Cantonese, and Mandarin to cater to HSBC’s diverse customer base in Hong Kong.

iWealth

Singapore’s DBS Bank launched a conversational AI platform named iWealth. It offers personalized investment information and responds to customer queries on wealth management.

COiN

JPMorgan Chase uses an AI system called COiN to review legal documents and contracts. It is not customer-facing like the other examples, but it shows how conversational AI can also improve internal operations.

Wells Fargo Facebook Messenger Chatbot

Wells Fargo has an AI-driven chatbot through Facebook Messenger. It helps customers get account information and reset passwords, which demonstrates the integration of conversational AI in social media platforms for banking services.

These are just a few examples that showcase how conversational AI is being implemented in banking to enhance customer service, improve operations, and provide personalized financial guidance.

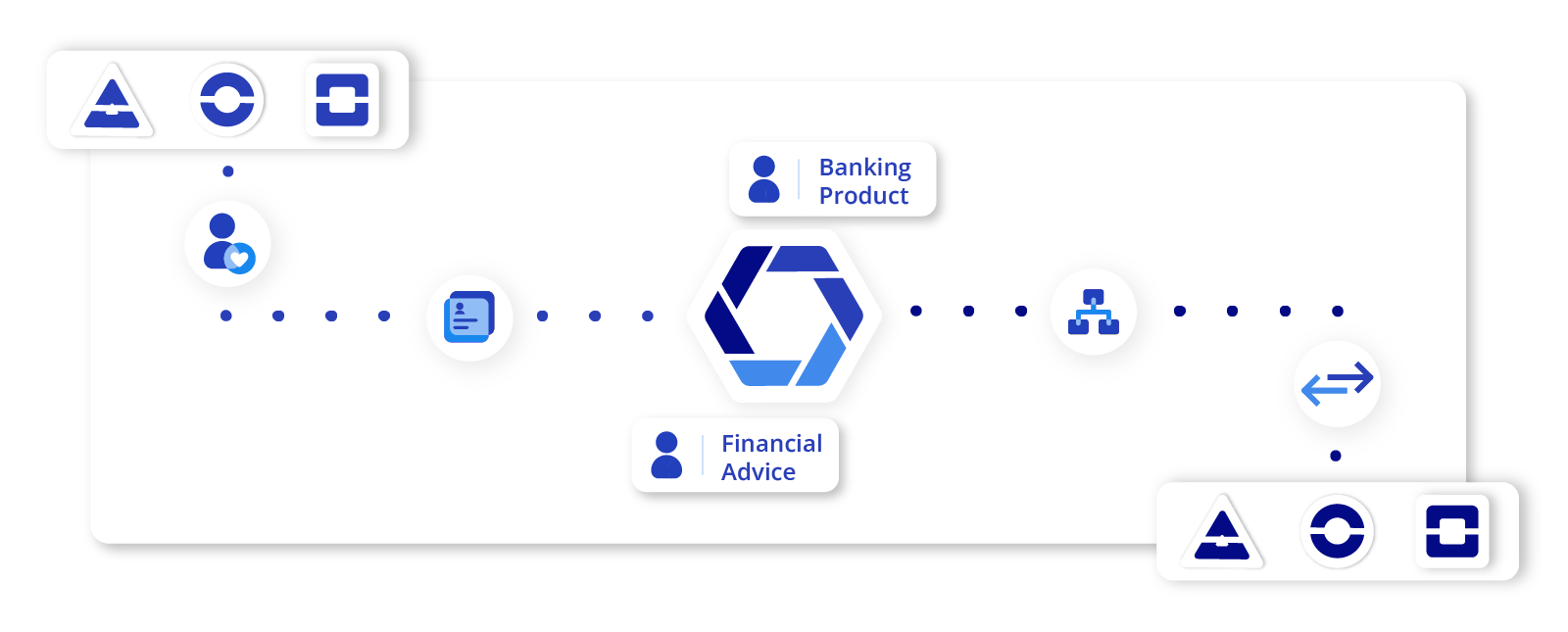

AI-Driven Personalized Financial Products and Services

AI is pivotal in personalizing financial products and services, transforming how banks interact with customers and meet their unique needs.

By leveraging machine learning algorithms and predictive analytics, AI allows banks to gain insights from large volumes of customer data, including transaction history, personal preferences, behavioral patterns, and social data.

Using these insights, financial institutions can create highly personalized offerings, from customized financial advice to tailored banking products.

Benefits of Personalized Offerings

Personalized financial products and services yield significant benefits for both customers and banks:

Improved Customer Experience

Personalization enhances the customer experience by offering products and services that align with a customer’s specific needs and circumstances. It makes customers feel understood and valued, thus improving customer satisfaction and loyalty.

Increased Conversion Rates

Personalized offerings tend to have higher conversion rates as they directly address the customer’s needs. Customers are more likely to opt for a product or service specifically tailored to their financial situation and goals.

Enhanced Customer Retention

Personalized offerings enhance customer retention by providing value that’s unique to each customer. Customers who find services that meet their needs perfectly are less likely to switch to other service providers.

Data-Driven Decision Making

AI-driven personalization provides banks with data-based insights that can inform decision-making processes. This leads to smarter strategies and enhances operational efficiency.

Competitive Advantage

In an increasingly competitive banking landscape, personalization can set a bank apart from its competitors. By offering tailored services, banks can attract new customers and retain existing ones.

Using AI to create personalized financial products and services is redefining the banking experience. It not only allows banks to meet and exceed customer expectations but also drives growth, profitability, and competitive advantage in the evolving banking landscape.

AI-Driven Personalized Financial Services in the Industry

Leveraging AI’s power, many banking institutions have started to offer personalized financial services to cater to individual customer needs.

JPMorgan Chase

JPMorgan Chase uses AI and machine learning to analyze customer data and offer personalized investment advice through their platform, J.P. Morgan Advisor. The system analyzes historical data and patterns to provide unique insights and tailored recommendations to clients.

Wells Fargo

Wells Fargo uses predictive banking, a feature in its mobile app that uses AI to analyze account information, to provide tailored financial guidance to its customers. The feature can anticipate customer needs and provide alerts on low account balances, automatic savings suggestions, and other personalized insights.

BBVA

The Spanish bank BBVA uses AI to create a personalized financial manager called Bconomy. The tool offers customers insights into their financial health and spending patterns and provides personalized recommendations to help improve financial habits.

Mastercard

Mastercard uses AI in its Decision Intelligence platform to analyze cardholder behaviors and tailor the user experience. By examining how cardholders use their cards, the system can modify security protocols for each individual, reducing false declines and improving the customer experience.

Ally Bank

Ally Bank’s AI-powered chatbot, Ally Assist, offers personalized assistance based on a customer’s transaction history and behaviors. It can answer questions, make transfers, and even predict upcoming expenses, providing a highly personalized banking experience.

These examples highlight how AI is driving personalization in the financial industry, leading to more tailored and effective services for customers.

Challenges and Concerns Surrounding AI in Banking

Implementing AI in banking has opened a wide array of possibilities, transforming the industry and redefining the banking experience. However, this technology also presents several challenges that must be addressed to ensure its effective, secure, and ethical use.

Data Security

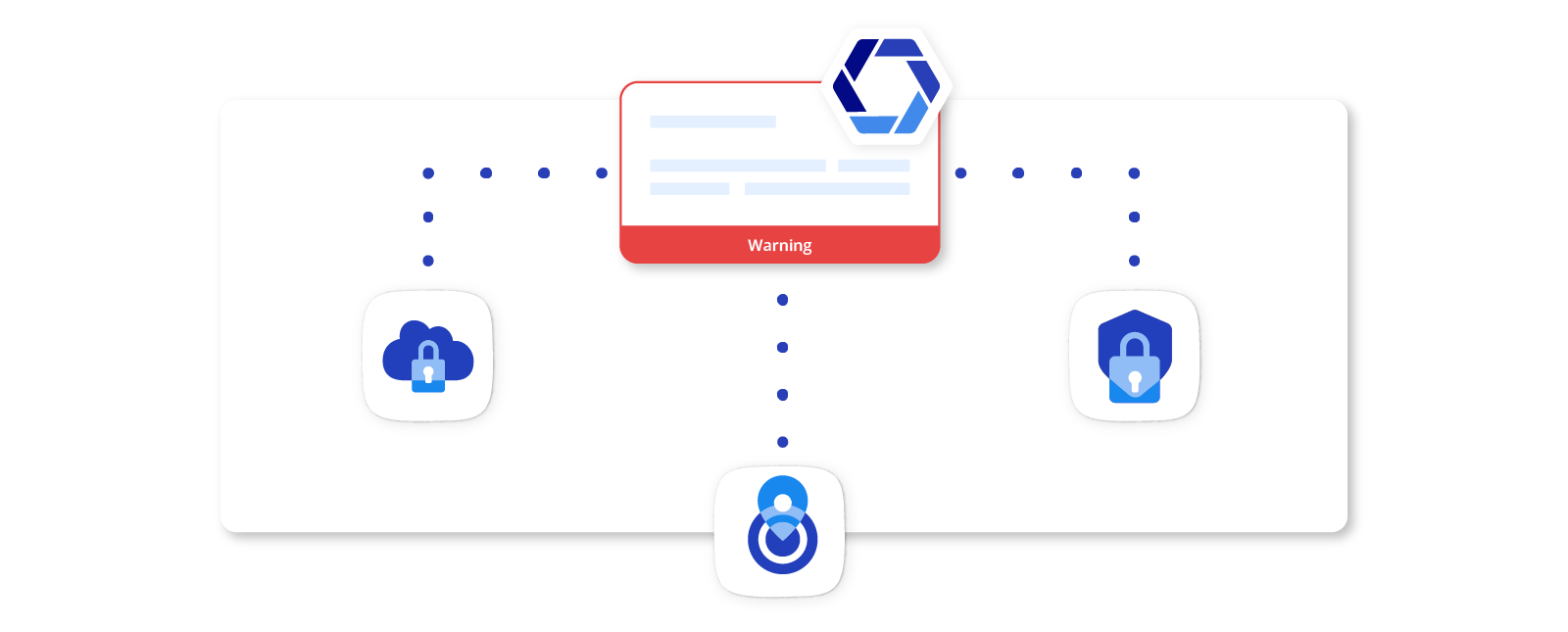

Data security is a paramount concern when implementing AI in banking.

AI systems, particularly machine learning algorithms, rely on vast quantities of data to operate effectively. This data often includes sensitive information such as customers’ personal details, financial records, and transaction histories.

Protecting this data from potential breaches is critical to avoid serious financial and reputational consequences. Breaches could result from cyberattacks, insider threats, or technical vulnerabilities.

Therefore, banks must invest in robust cybersecurity measures, including advanced threat detection systems, secure data storage solutions, and rigorous data access controls. Regular security audits and updates are also essential to keep up with evolving cybersecurity threats.

Data Privacy

Alongside data security, ensuring the privacy of customer data is crucial. Banks must navigate a complex landscape of data protection regulations, such as the EU’s General Data Protection Regulation. With AI systems processing extensive customer data, banks must ensure they’re using this data ethically, transparently, and in full compliance with privacy laws.

Customers should be informed about how their data is being used and must be able to opt out if they wish. Anonymization and pseudonymization techniques can also be used to protect privacy by preventing the identification of individuals from the data being processed.

Algorithmic Bias and Ethical Considerations

Ethical considerations surrounding AI in banking extend beyond data privacy. One significant concern is the potential for algorithmic bias.

AI systems learn from the data they are trained on. If this data reflects existing biases, the AI system may also demonstrate bias in its decisions. For example, if a loan approval algorithm is trained on historical data that reflects discriminatory lending practices, the algorithm may perpetuate these practices by denying loans to certain demographic groups.

Banks need to be aware of this risk and take steps to eliminate bias from their AI systems. This may involve using diverse and representative training data, regularly auditing AI systems for bias, and implementing AI explainability measures to understand how decisions are being made.

Explainability and Transparency

AI systems, particularly those based on complex machine learning models, often operate as “black boxes.” Their decision-making processes can be difficult to understand, leading to a lack of transparency. This lack of transparency can create trust issues among customers and potentially result in regulatory scrutiny.

Banks must ensure their AI systems can provide clear, understandable explanations for their decisions. This could involve using AI explainability tools or opting for simpler, more interpretable AI models where possible.

Regulation and Compliance

As a rapidly evolving field, AI in banking is subject to a dynamic and complex regulatory landscape. Banks must ensure that their AI systems remain compliant with changing regulations. This involves not only keeping up to date with current legislation but also anticipating future regulatory changes.

Banks may need to work closely with regulators, legal experts, and AI specialists to navigate these challenges. Regular compliance audits and AI governance frameworks can also be beneficial.

These challenges highlight the need for a balanced and thoughtful approach to AI implementation in banking. While it has the potential to greatly enhance efficiency, customer experience, and profitability, it also brings significant risks and complexities.

By addressing these challenges head-on, banks can make the most of AI’s potential while ensuring data security, privacy, ethical integrity, and regulatory compliance.

The Future of AI in Banking and Financial Services

AI is set to further revolutionize the banking sector, fostering innovation, improving efficiencies, and enhancing customer experiences. Here are some potential trends and developments in AI for banking, including its impact on decentralized finance and financial inclusion.

Greater Personalization

As AI technology becomes more sophisticated, it is expected to provide unprecedented levels of personalization in banking.

Using detailed customer data and predictive analytics, it can offer customized financial advice, tailored product recommendations, and personalized customer experiences. This increased personalization will help banks better meet individual customer needs, improving customer satisfaction and loyalty.

AI and Decentralized Finance (DeFi)

AI is expected to play a key role in the emerging DeFi sector, which aims to use blockchain technology to recreate and improve traditional financial systems. AI could contribute to the growth and development of DeFi in several ways.

For example, machine learning algorithms can help assess the risks of DeFi investments, while AI-powered smart contracts can automate and streamline DeFi transactions. As DeFi continues to evolve, AI will likely be a major driving force behind its innovation and expansion.

Enhanced Risk Management and Fraud Detection

AI’s ability to analyze vast amounts of data in real-time makes it an invaluable tool for risk management and fraud detection. By identifying unusual patterns and anomalous behavior, AI can help to prevent fraudulent transactions, reduce financial risks, and enhance overall banking security.

AI for Financial Inclusion

AI also holds the potential to promote financial inclusion. By leveraging AI, banks can reach and serve underserved populations who might not have access to traditional banking services.

For instance, AI algorithms can use non-traditional data sources to assess the creditworthiness of individuals without a credit history. AI can also help develop affordable financial products tailored to the needs of lower-income individuals.

Improved Banking Experience Through Conversational AI

Conversational AI, including chatbots and voice assistants, will become increasingly integral to the banking experience. These technologies can offer 24/7 customer support, respond to customer queries in real time, and provide a more interactive and engaging banking experience.

AI and Regulatory Compliance

AI can simplify and streamline the process of regulatory compliance in banking. By automatically checking transactions against regulatory standards and predicting future regulatory changes, it can help banks to ensure continual compliance, reducing the risk of costly penalties and reputational damage.

AI-Driven Cybersecurity

With cyber threats becoming increasingly sophisticated, AI will be crucial for cybersecurity in banking. It can help detect potential threats, respond effectively to security breaches, and safeguard sensitive customer data.

As these trends demonstrate, AI is set to profoundly reshape the future of banking, driving innovation and enhancing customer experiences.

Real-World Examples of AI in Banking

As AI continues to transform the banking sector, several real-world examples illustrate its impact. Let’s take a closer look at some financial institutions that have successfully integrated AI into their operations and the resulting benefits they’ve experienced.

JPMorgan Chase

JPMorgan Chase, a leading global financial services firm, has successfully leveraged AI in several aspects of its operations.

One notable example is their Contract Intelligence (COiN) platform, which uses natural language processing to review and analyze legal documents, significantly reducing the time and resources required for these tasks. The firm also uses machine learning algorithms for fraud detection and predictive analytics to enhance security and make more accurate forecasts.

By adopting AI, JPMorgan has reported increased efficiencies, particularly in the processing of legal documents. Their fraud detection has also improved, enhancing security and customer trust.

Bank of America

Bank of America’s virtual assistant, Erica, is a great example of how AI can improve customer service in banking. It uses AI and predictive analytics to help customers with budgeting, payments, and general account queries.

Erica has proven highly popular, with millions of customers using the service. It has improved customer engagement and satisfaction while reducing the burden on the bank’s customer service team.

HSBC

HSBC has adopted AI to enhance its anti-money laundering and fraud detection efforts. By using AI to analyze transactions in real-time, it can identify suspicious activities more effectively and respond to potential threats more swiftly.

Its use of AI in risk management has led to faster and more accurate detection of suspicious transactions, which has not only improved security but also resulted in cost savings by reducing the need for manual review.

Royal Bank of Scotland (RBS)

RBS has developed a natural language processing AI, known as Luvo, to handle customer queries. It can understand and respond to various questions and direct customers to relevant information and services.

Luvo has enabled RBS to provide faster, more efficient customer service. It has also freed up human staff to handle more complex queries, enhancing their overall productivity.

Standard Chartered

This bank has leveraged AI for personalized banking services, using machine learning algorithms to analyze customer data and deliver personalized product recommendations.

Ai has helped Standard Chartered better cater to individual customer needs, improving customer engagement and retention.

AI in Banking – A Revolutionary Shift

AI has already made significant strides in the banking and financial services industry. It has reshaped traditional operations and introduced a new paradigm of services for customers. From improving customer experiences through conversational AI to enhancing security with advanced fraud detection and risk management systems, AI’s transformative impact is indisputable.

We’ve explored the diverse applications of AI in banking, including its role in fraud detection, risk management, and customer service. We’ve also discussed how AI helps create personalized financial products and services, enhancing customer experiences and fostering stronger relationships.

The potential of AI extends into the future, with trends indicating that it will shape not just the future of banking but also the entire financial services sector. DeFi, AI-driven regulatory compliance, and financial inclusion are just some areas where AI is expected to make a notable impact.

However, the adoption and implementation of AI are not without challenges. Issues around data security, privacy, and ethical considerations must be proactively managed. Effective strategies such as stringent data protection policies, ethical AI practices, and continuous monitoring should be implemented to mitigate these challenges.

AI is not just a fleeting trend; it’s the future of banking. To stay competitive and relevant, banks and financial institutions must embrace AI and leverage its potential to improve services, optimize operations, and ultimately, provide superior value to customers. The road to AI integration may be complex, but its rewards are worth the journey.

Learn more about how AI and automation solutions can bring unprecedented speed and agility to your financial services operations. Get in touch with Kizen to collaborate on a solution for your enterprise today.

Demystifying AI in Banking: Frequently Asked Questions

In the ever-evolving landscape of AI in banking, it’s natural to have questions.

This section is dedicated to answering some of the most frequently asked questions about AI in banking, providing insights into everything, from customer service enhancements to risk management solutions.

How is AI integrated into mobile banking applications?

AI enhances both functionality and user experience in mobile banking applications. Through its integration, these applications can become more user-friendly, efficient, and secure.

One common AI integration is through conversational AI, such as chatbots and virtual assistants. These tools can help customers perform banking tasks, answer queries, and even provide personalized recommendations while reducing the need for human intervention.

Furthermore, AI is used to bolster security measures within mobile banking applications. This includes using AI-powered fraud detection algorithms and biometric authentication methods, such as voice recognition and facial recognition, to enhance the overall safety of mobile banking operations.

AI also significantly enhances user experience by providing personalized services. For instance, it can analyze a user’s banking history and behavioral patterns to offer tailored financial advice, product recommendations, and alerts. This level of personalization enables a more engaging and satisfying user experience, fostering loyalty and trust.

Some mobile banking apps that use AI are Erica by Bank of America and Cleo, an AI financial assistant that connects with various bank accounts and credit cards to analyze spending, provide insights, and help users save money. These apps show how AI integration can revolutionize the mobile banking experience, making it more intuitive, secure, and personalized.

How does AI contribute to sustainable and responsible banking?

AI promotes sustainable and responsible banking practices, contributing to the achievement of Environmental, Social, and Governance (ESG) goals. It can facilitate efficient and accurate analysis of large data sets and help banks identify sustainability risks and opportunities in their portfolios.

For instance, AI algorithms can assess clients’ ESG performance, evaluate potential ESG-related risks in loan portfolios, and identify sustainable investment opportunities. Additionally, predictive AI models can forecast the impact of environmental factors on a bank’s operations, enabling proactive risk management.

AI can also support responsible banking practices by improving transparency and accountability in financial transactions, detecting and preventing fraudulent activities, and enhancing customer data protection.

Several banks and financial institutions are already leveraging AI to facilitate sustainable banking practices. For instance, UBS uses AI to analyze companies’ sustainability performance and provide clients with sustainable investment options. Meanwhile, Dutch bank ING uses AI to analyze loan portfolios for sustainability risks and opportunities.

AI is also being used in developing “green fintech” solutions, such as apps that use AI to provide customers with insights into the environmental impact of their spending habits and advice on making more sustainable financial decisions.

By leveraging AI, banks can not only enhance their sustainability efforts but also drive innovation, improve risk management, and create value for both their stakeholders and society at large.

What role does AI play in data analysis and decision-making in banking?

Given the vast volumes of data banks handle daily, AI plays a crucial role in data analysis and decision-making in the banking industry. AI, especially machine learning algorithms, can sift through massive amounts of data and extract valuable insights that would be otherwise impossible to discern manually.

AI tools can analyze customer data to predict behaviors, identify trends, and detect anomalies, assisting banks in making data-driven decisions. These decisions can range from determining creditworthiness for loan approvals to identifying potential fraudulent activities.

AI’s capabilities extend to real-time decision-making as well. For example, AI-driven systems can instantly decide whether to approve or deny a transaction based on a customer’s historical data and patterns. This not only helps in preventing fraudulent transactions but also improves the customer experience by reducing wait times.

One notable example of AI-driven data analysis in banking is JPMorgan’s COiN system. This AI program analyzes legal documents and extracts relevant data, a process that would typically consume thousands of hours if done manually.

This capability significantly accelerates decision-making and reduces errors, underscoring AI’s significant role in data analysis and decision-making within the banking industry.

How is AI used in banking cybersecurity?

Given the sensitive nature of financial data and the increasing sophistication of cyber threats. AI can be used to strengthen various aspects of cybersecurity, from threat detection to response strategies.

AI systems can continuously monitor network traffic and user behavior to detect anomalies or suspicious activities that could indicate a potential cyber-attack. Machine learning algorithms can be trained to recognize patterns associated with specific threats, enabling early detection and more rapid response.

AI can also aid in preventing data breaches by implementing advanced security measures. For example, AI-driven biometric authentication methods like facial or voice recognition provide an additional layer of security, making it harder for cybercriminals to gain unauthorized access.

It can also help predict potential security vulnerabilities by analyzing previous incidents and identifying patterns. One AI application in banking cybersecurity is the use of AI-powered fraud detection systems. These systems can analyze numerous transactions in real-time to detect potentially fraudulent activities, significantly reducing the risk of financial loss.

Citibank, for example, uses AI to analyze customer payment patterns and detect anomalies that may suggest fraud, thereby enhancing its cybersecurity measures.

How can AI help in compliance and regulatory reporting in banking?

Compliance and regulatory reporting processes in the banking industry often involve analyzing vast amounts of data and can be time-consuming and prone to human error.

AI systems, particularly those using machine learning and natural language processing, can automate the extraction, analysis, and reporting of relevant data, increasing accuracy and efficiency. AI can also be used to continually monitor banking operations to ensure ongoing compliance, identify potential breaches, and implement corrective measures.

Using AI in compliance presents several benefits for both banks and regulators. For banks, it can result in significant cost savings, reduce the risk of non-compliance penalties, and free up resources for other critical tasks. For regulators, AI can provide more accurate and timely data, aiding in more effective oversight.

Several banks are already leveraging AI to enhance their compliance functions. For example, HSBC deploys AI to comply with anti-money laundering and fraud regulations by identifying suspicious activities among millions of daily transactions.

Once a potentially fraudulent activity is identified, it is flagged for further review by the bank’s security team. This saves time and ensures potential threats are swiftly addressed, thereby improving the overall security of its operations.

How can AI improve the efficiency of banking operations?

AI improves the efficiency of banking operations by automating repetitive and time-consuming tasks, leading to faster, more accurate processes. AI-powered chatbots, for example, can handle a wide range of customer inquiries round-the-clock, freeing up human resources for more complex tasks.

AI can also enhance efficiency in loan processing by using machine learning algorithms to assess creditworthiness, drastically reducing the time required for loan approvals.

For banks, improved efficiency translates into cost savings, increased productivity, and the capacity to deliver services more quickly. For customers, it means faster response times, instant services, and a more seamless banking experience.

Take Deutsche Bank as an example. Deutsche Bank introduced an AI-based system for their corporate and investment banking team to expedite the reading and responding to emails.

This system, called “Max,” helps automatically categorize, prioritize, and create responses to emails. It can process around 350,000 emails a day, which has led to considerable efficiency gains and reduced manual labor.