Insurance automation is becoming increasingly important for insurance companies, agents, brokers, claim adjusters, and data privacy officers in today’s digital age. By leveraging technologies like robotic process automation (RPA), insurers can revolutionize their operational efficiency, enhance customer experience, and reduce costs.

This article explains the basics of insurance automation and demonstrates how businesses can embrace this commanding change.

Insurance Automation: The Basics

Insurance automation refers to the application of technologies, such as RPA, to automate manual, routine, and often time-consuming tasks traditionally performed by humans within the insurance industry.

From issuing policies to processing claims, automation is streamlining insurance functions in ways unimaginable a few decades ago. Its significance lies in its ability to improve efficiency, accuracy, and productivity while reducing human error.

Moreover, insurance automation empowers insurance professionals by freeing them from mundane tasks, allowing them to focus on high-value activities that necessitate human intellect and personal touch, such as customer relationship building and strategic planning.

Robotic Process Automation in the Insurance Industry

Robotic process automation (RPA) has proved to be a game-changer for the insurance industry. RPA, like a virtual workforce, executes tasks, mimicking human actions. It’s particularly useful in handling repetitive, high-volume tasks that are otherwise time-consuming when done manually.

In insurance, RPA can efficiently process workflows—be it document verification, data entry, or claim processing. This means tasks that used to take days can now be completed in minutes or hours, with improved accuracy and minimal errors, resulting in faster processing times and significant cost savings for insurance companies.

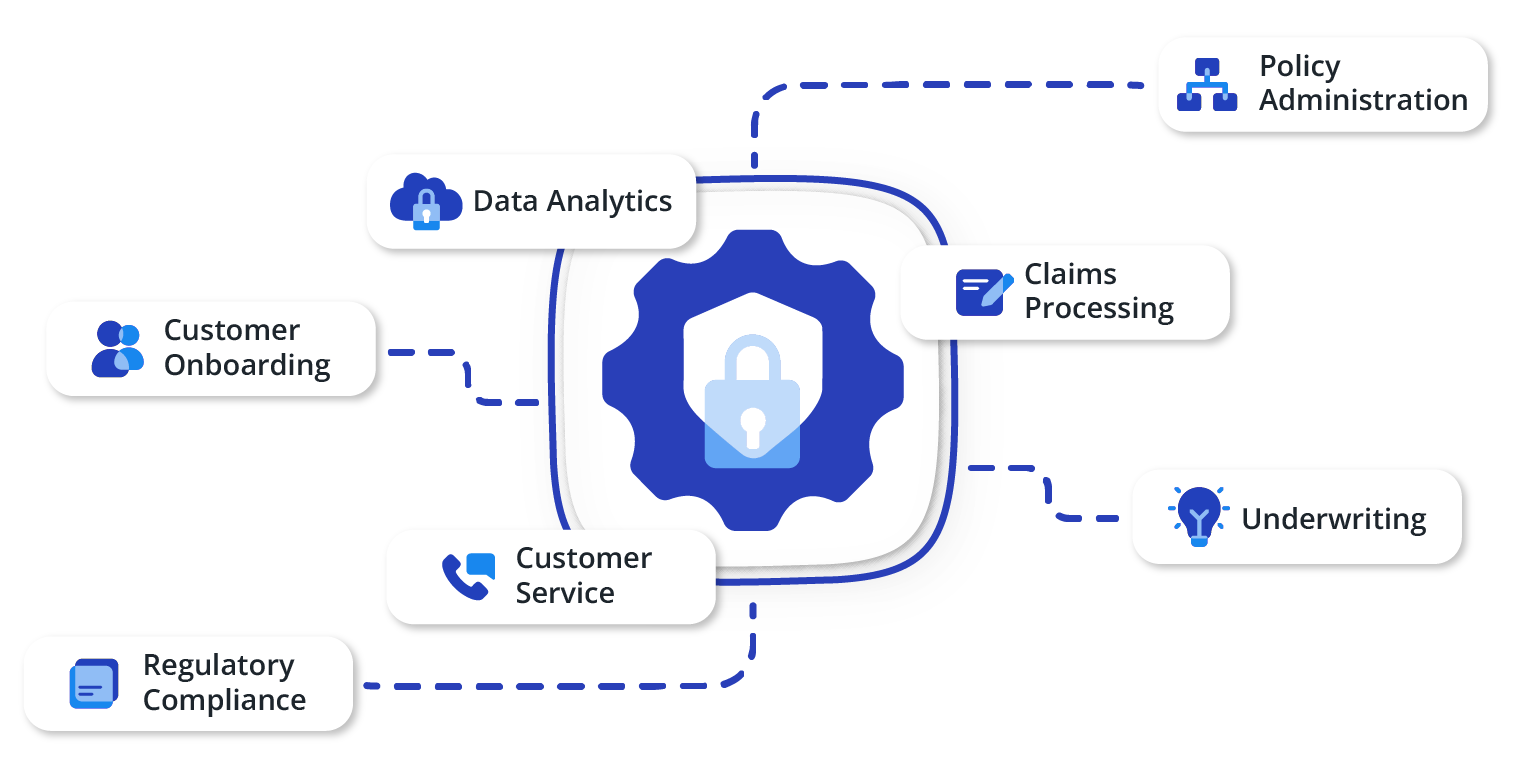

7 General Use Cases of Insurance Automation

Insurance automation boosts efficiency and productivity across different operational areas, as outlined below.

Policy Administration

Policy administration is the backbone of any insurance company, involving various tasks, from issuing policies to managing renewals and handling endorsements. Leveraging insurance automation in these critical functions can not only streamline these processes but also improve decision-making, accuracy, and customer satisfaction.

Policy Issuance

Automation helps promptly retrieve and validate policyholder data, significantly accelerating policy issuance. It not only eliminates the risk of manual errors but also enhances the customer experience with faster service.

Renewal

Insurance automation improves customer retention with timely automated reminders for policy renewals, ensuring customers are always covered.

Endorsement

Robotic process automation facilitates timely and accurate policy endorsements, negating the risk of manual errors and ensuring all endorsements are correctly recorded and implemented.

Claims Processing

Claims processing is a critical touchpoint in the insurance customer journey, where efficiency, speed, and accuracy can significantly impact customer satisfaction and operational costs. By harnessing automation, insurers can make claims processing faster, more precise, and more robust, empowering both the business and its customers.

Automated Data Entry

RPA bots can automatically extract, organize, and input data with impeccable accuracy, eliminating the risk of human errors and speeding up claims processing times.

Claim Adjudication

Automation in claim adjudication enables faster decision-making, ensures consistency, and improves the overall efficiency of the claim-handling process.

Fraud Detection

Through automation, insurers can sift through massive data to identify potentially fraudulent claims, improving the insurance company’s ability to detect and mitigate fraud effectively.

Underwriting

Underwriting is the foundation of insurance operations, determining the risks the company can insure and at what premium. Incorporating automation can dramatically elevate underwriting’s effectiveness and accuracy, ultimately leading to more informed underwriting decisions and profitable outcomes.

Data Gathering

Automation simplifies collecting and validating extensive client data, making the underwriting process faster and more efficient.

Preliminary Risk Assessment

RPA’s ability to promptly analyze large amounts of data helps underwriters conduct thorough initial risk assessments, contributing to more accurate underwriting decisions.

Customer Service

Customer service is the heart of the insurance industry. By adopting automation, insurance companies can provide superior customer service that’s not only quick and efficient but also personalized and available round-the-clock, significantly improving the customer’s experience.

Chatbots

AI-powered chatbots can handle various customer queries around the clock, providing a responsive and seamless service experience.

Automated Communication

Automated emails, texts, or app notifications enhance customer experience by providing timely updates, policy details, and other relevant information.

Regulatory Compliance

Regulatory compliance is non-negotiable in the insurance industry, given the stringent and ever-evolving regulations. By deploying automation, insurers can effectively meet these regulatory requirements, ensure accurate reporting, and streamline audits, minimizing the risk of non-compliance and fostering transparency and trust.

Reporting

Automated reporting generates detailed, accurate, and timely reports that significantly improve regulatory compliance.

Auditing

RPA simplifies the audit process by providing quick and efficient access to error-free data, making audits more reliable and less time-consuming.

Customer Onboarding

Customer onboarding is a critical first step in establishing a strong customer–insurer relationship. Using automation in this phase can significantly enhance the customer experience by ensuring a quick, seamless, and error-free onboarding process. This sets the foundation for long-term customer relationships.

Data Collection and Validation

Automation tools can swiftly gather and validate customer data during onboarding, resulting in a seamless and accurate onboarding experience.

Integration with CRM

RPA facilitates the integration of customer data with CRM systems, leading to effective customer relationship management.

Data Analytics

Data analytics is a powerful tool in the insurance industry, driving strategic decisions and identifying opportunities for improvement. When combined with automation, data analytics becomes even more powerful. It allows insurers to quickly identify inefficiencies, predict customer behavior, and make informed decisions to increase efficiency and retain customers.

Identify Inefficiencies

Automation can quickly identify bottlenecks and inefficient areas in the workflow, enabling companies to promptly address them.

Churn Analysis

Automated predictive analytics can preemptively identify possible customer churn, allowing insurance companies to implement strategies to improve customer retention.

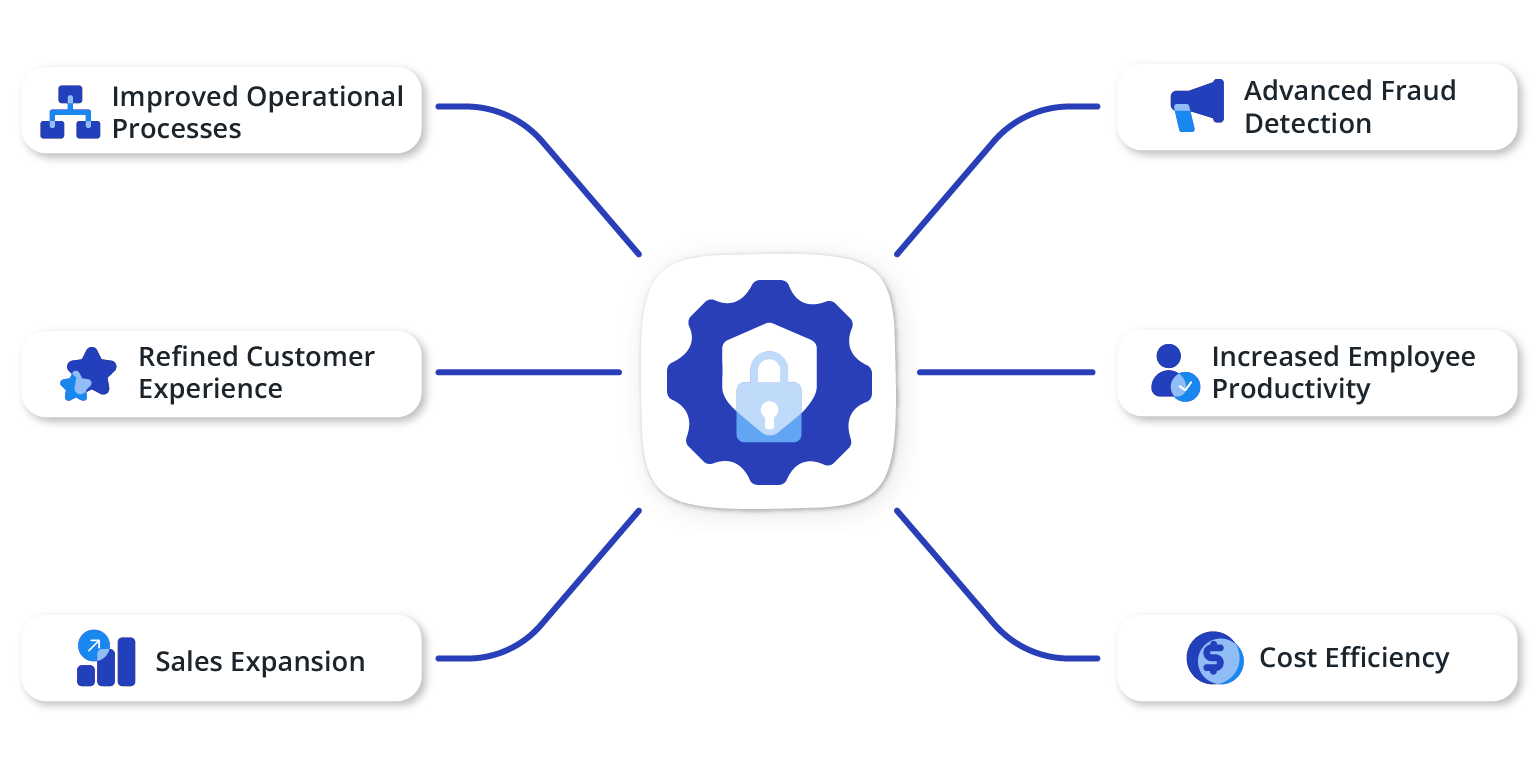

Ways Businesses Benefit From Insurance Automation

Improved Operational Processes

RPA and AI can streamline insurance processes, reducing manual effort and errors. Automated workflows can handle tasks such as data entry, report generation, and policy issuance, enhancing process accuracy and efficiency.

Insurance automation can quickly process vast amounts of data, leading to better decision-making and faster turnaround times. This overall efficiency promotes business growth and customer satisfaction.

Refined Customer Experience

Customers today are accustomed to instant gratification. Manual processes often cannot match this expectation, but automation can. It facilitates swift claim processing, reducing waiting times.

Furthermore, AI-powered chatbots and automated communication keep customers informed about their policies, claims, and renewals. This enhances the customer’s journey, fostering loyalty and satisfaction.

Sales Expansion

Insurance automation frees agents to focus on strategic initiatives instead of administrative tasks. They can spend more time on customer-facing activities such as lead generation, customer service, and cross-selling.

By automating the sales process, insurance companies can manage leads more effectively, track the sales pipeline, and close deals faster, driving sales growth.

Advanced Fraud Detection

Insurance fraud is a pervasive issue, costing insurance companies billions of dollars each year. Automation, powered by predictive analytics, can help identify fraudulent activities more effectively. Machine learning algorithms can analyze extensive data for patterns or anomalies indicating fraudulent activity.

This way, insurance automation not only saves money but also establishes trust in the claims process.

Increased Employee Productivity

Automation removes the burden of mundane tasks from employees. They are no longer required to do time-consuming data entry or manual checks. Instead, they can focus on value-added activities requiring human intelligence and expertise, such as policy planning, relationship management, product innovation, and more.

This shift increases employee productivity, job satisfaction, and, ultimately, business success.

Cost Efficiency

Automation cuts down operational costs by minimizing errors and speeding up processes. For instance, automated data entry and processing reduce the cost of rectification, while the swift processing of claims reduces the costs associated with delays.

Over time, these savings can significantly impact the company’s bottom line, making automation a smart financial decision.

Primary Ethical Considerations in Automating Insurance Processes

As insurance automation gains traction, it’s crucial to reflect on the ethical implications that come with it. Here are some key ethical considerations:

Data Privacy and Security

With data breaches being a constant threat, protecting sensitive customer information is more critical than ever. Automated systems, despite their numerous benefits, are not immune to cyberattacks. Insurance companies must implement stringent security measures such as data encryption and access controls to safeguard customer data and maintain regulatory compliance.

Transparency in Data Collection

Insurance automation often involves the collection of a wealth of data, and it’s important to keep this data collection transparent. Customers should know what data is being collected, why it is being collected, how it will be used, and with whom it may be shared. This transparency fulfills legal requirements and builds trust with policyholders.

Clear Accountability

Despite the many advantages of automation, it can sometimes go wrong. When these instances occur, companies should take responsibility instead of blaming the automated system.

Clear accountability protects the company’s reputation and demonstrates responsible and ethical behavior. Mechanisms should be in place to identify and rectify any shortcomings of the automated system.

Clarity and Understanding

Automation may seem complex and overwhelming to customers. Clear communication about how automation works, its benefits, and its limitations is important to avoid misunderstandings and build trust.

This understanding improves customer satisfaction and helps maintain a positive market reputation. It ensures that customers can make informed decisions about their insurance options.

Bias and Discrimination

Ensuring fairness in automated processes is a significant ethical challenge. Certain algorithms may unintentionally produce biased or discriminatory outcomes. To prevent such, it’s important to monitor and periodically review automated processes and use diverse and inclusive data for training AI models.

Insurance Automation: Future Trends

Insurance automation is persistently evolving, constantly introducing transformative innovations that redefine traditional insurance operations. Let’s explore some of these cutting-edge trends.

Blockchain for Policy Management

Blockchain technology, known for its transparency and immutability, could revolutionize insurance policy management by providing assuredly accurate records of all insurance policies issued, renewed, or expired and enabling the automation of claims processing through smart contracts — self-executing contracts with the terms of the agreement written into code.

This technology could eliminate disputes, increase efficiency, and reduce costs in policy management.

Telematics in Auto Insurance

Telematics technology, which monitors individual driving behaviors, such as speed, braking habits, and the time of day the vehicle is in use, has the potential to transform auto insurance.

Insurers can offer personalized policies based on driver risk profiles, leading to safer driving habits, fairer premiums, and improved customer experiences, marking a significant shift from the traditional “one-size-fits-all” approach.

AI-Driven Chatbots for Customer Service

AI is becoming more sophisticated and intuitive, paving the way for the next generation of chatbots.

Future AI-powered chatbots will provide more personalized, interactive services by understanding user emotions and intent, learning from past interactions, and assisting with complex queries and claim filing. Available 24/7, these chatbots can significantly enhance customer experiences and provide a strategic advantage.

A Promising Future with Insurance Automation

Insurance automation is not merely a trend but a commanding change reshaping the insurance industry. With various applications, from policy administration to claims processing and regulatory compliance, automation paves the way for operational efficiency, better customer service, and cost savings.

It’s imperative for insurance companies to adapt to this digital revolution and partner with experts like Kizen to fully leverage insurance automation while effectively addressing ethical considerations. Automation is not the future of the insurance industry; it’s the present steering the industry toward a promising future.

Connect with us today, and let’s discuss your automation needs.