Picture this: financial reports generated in a snap, invoices processed without human intervention, and errors becoming a thing of the past. Sounds like a CFO’s dream, right?

Today, finance automation is key for organizations seeking accuracy and growth. This guide will show how automating financial processes can elevate businesses and improve user experiences.

Dig in to unlock the secrets of streamlined financial management and understand how you can transform the heartbeat of your enterprise: its finances.

Finance Automation: The Basics

Navigating finance can feel like you’re lost in a maze of numbers, regulations, and processes. As businesses grow, managing financial tasks gets more complex.

Finance automation offers a solution for efficiency and accuracy in this complex industry.

Definition and Basic Concept

Finance automation is the integration of technology into financial operations. But what exactly does this entail?

Imagine repetitive financial tasks like invoicing and budgeting done quickly and accurately without much human effort. Finance automation turns manual, tedious tasks into streamlined operations that are not only faster but also more accurate.

When we talk about finance automation, we look beyond just cutting down on manual data entry. We envision a holistic system where financial data flows seamlessly, reports generate themselves in real-time, and anomalies are flagged without a human combing through heaps of data.

It’s like equipping your financial department with an incredibly efficient co-pilot who works 24/7 and is exceptionally good at spotting and avoiding potential mistakes.

Connection to Machine Learning and RPA

Many think automation is just basic scripts running mundane tasks. But finance automation today is vastly more sophisticated and powerful, thanks to machine learning (ML) and robotic process automation (RPA).

Machine learning in finance automation is like giving your software the ability to think and learn. Instead of following predefined rules, ML-enabled systems analyze vast financial data, recognize patterns, and make predictions.

For instance, ML can help predict future sales based on historical data, identify potential financial risks, or even forecast market trends. And the beauty of it all? These systems become more accurate over time, learning from new data and refining their predictions.

On the other hand, robotic process automation is all about mimicking human tasks at lightning speed. Consider RPA as virtual finance clerks that can process invoices, reconcile bank statements, or manage payroll without tiring or making mistakes.

Unlike traditional business automation that follows a set script, RPA bots can navigate software like a human, making decisions based on the data they encounter.

Combining machine learning’s predictive prowess with robotic process automation’s operational efficiency results in a financial management system that’s not only responsive but also proactive. It’s a dynamic duo that can adapt to changing business environments, forecast potential challenges, and manage day-to-day tasks with unparalleled precision.

Importance in Various Industries

The power of finance automation isn’t limited to just one sector. Its impact reverberates across industries, reshaping how businesses operate. Each industry, with its unique challenges, adapts finance automation to meet its specific needs.

Banking

In banking, where vast volumes of transactions occur daily, finance automation has become indispensable. It not only manages numbers; it improves the essence of banking services.

By using finance automation, banks can predict loan defaults with high accuracy, saving them from potential bad debts. Transactions have also been simplified that they barely need manual checks.

Moreover, automation speeds up fraud detection by quickly detecting irregular patterns and flagging suspicious activities, making banking more secure and trustworthy for customers.

Retail

The retail sector thrives on small margins and volume sales. Thus, efficient financial management can be the difference between profit and loss.

With finance automation, retailers can now precisely manage inventory costs, ensuring optimal stock levels and minimizing deadstock. Real-time sales data analysis means retailers can react quickly to market trends, optimizing pricing, promotions, and stock management.

Moreover, the relationship between retailers and their suppliers is strengthened as automated systems ensure timely and accurate payments, fostering trust and long-term partnerships.

Healthcare

The healthcare industry, known for its complex operations, often struggles with complicated financial processes. Automated billing systems are transforming this space, significantly reducing discrepancies that once led to financial losses and patient dissatisfaction.

Insurance claims are processed faster, resulting in quicker payouts and fewer errors. Furthermore, updating patient payment systems has become seamless, ensuring patients are billed accurately, and healthcare providers maintain a steady cash flow.

Real estate

In the real estate market, timing and accurate valuation are everything. Finance automation helps realtors and property managers by providing real-time property valuations based on various variables, from market trends to local amenities. This aids in purchase and selling decisions and ensures fair pricing for all parties.

Once a paperwork-heavy process, lease management has now been digitized, reducing errors and increasing efficiency. Additionally, adding AI to finance automation provides forecasts that consider global trends and events, giving a comprehensive view of the property market’s future direction.

Processes Suitable for Automation

Deciding which financial processes to automate can be daunting, given the range, from simple ledger tasks to complicated payroll. However, some tasks like those below are prime candidates for automation because of the efficiency gains they offer.

Accounts Receivable

Accounts receivable (AR) is often the lifeline of an organization’s cash flow, and any bottlenecks or delays can affect the company’s financial health.

Automating AR transforms this essential function into a highly efficient and responsive unit. Instead of manually drafting and sending out invoices, automation tools can generate them based on predefined criteria and ensure they’re sent out promptly.

Payment reminders, rather than being a manual chore, are dispatched automatically based on due dates, reducing overdue payments. Advanced systems can also facilitate automated collections based on customer profiles, past payment behavior, and more. The result? Faster payments, improved cash flow, and less time overseeing AR.

Payroll

Payroll is the heartbeat of any organization. Errors here, be it in amounts or timelines, can severely impact morale and trust.

Automated payroll means no more manual tax or benefit calculations, ensuring every employee is paid accurately and on time precision. This makes employees trust the organization’s system more and frees HR to focus on strategic initiatives rather than getting bogged down in numbers.

Purchase Order Management

Managing purchase orders (PO) is a balancing act, ensuring businesses get what they want when they need it.

Automated systems suggest order quantities based on past data and future projections, digitally process approvals, and track deliveries, ensuring that goods received match the PO and triggering payments accordingly.

Thus, automating purchase order management not only streamlines operations but also strengthens the supply chain, fostering better relationships with suppliers and ensuring consistent availability of essential products or services.

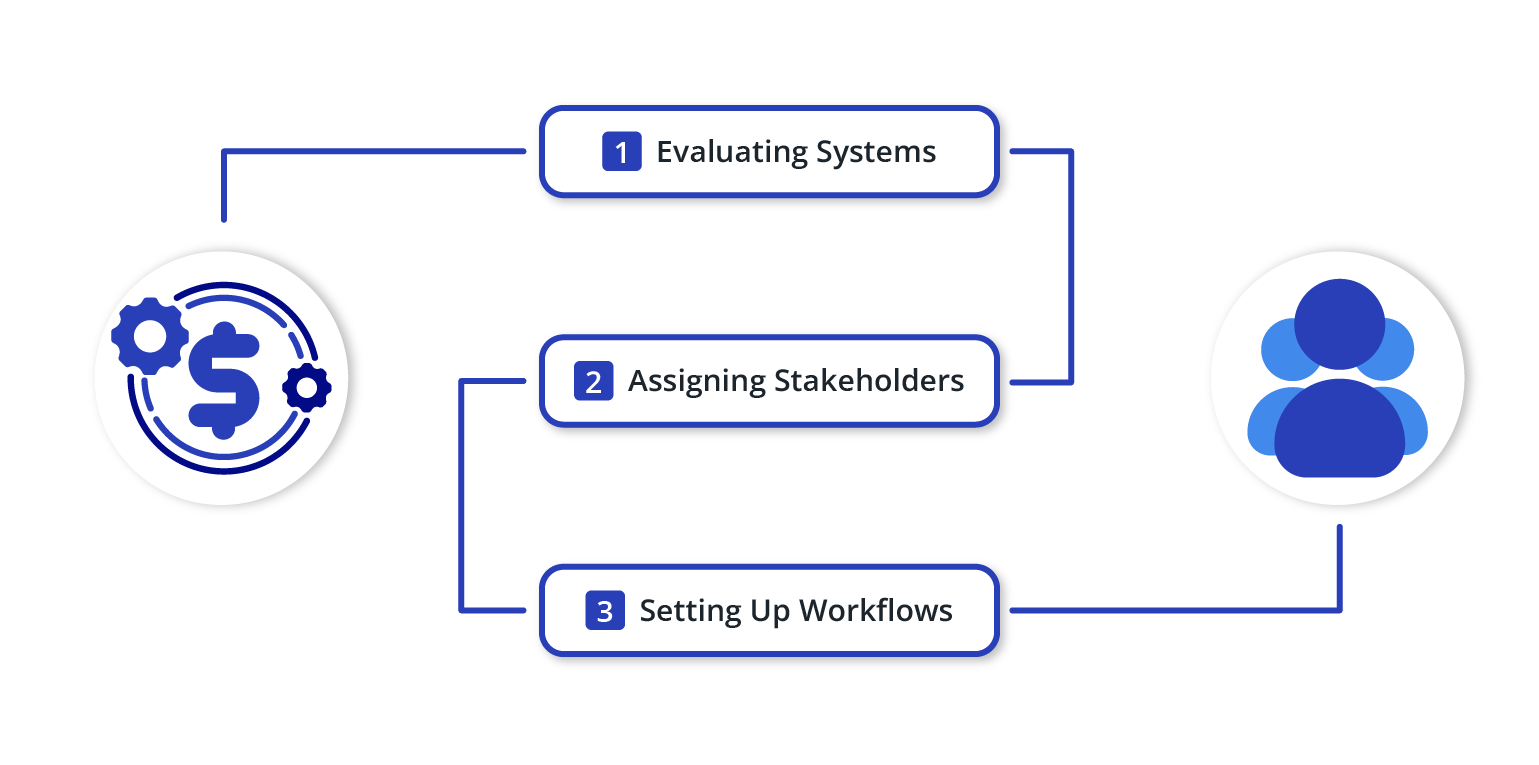

How to Implement Finance Automation

Embracing finance automation promises streamlined operations and enhanced accuracy. However, its implementation requires a structured approach, blending technological tools with strategic insights. Here’s a simple guide on making that shift.

Evaluating Systems

Start by identifying gaps in your existing financial processes. What tasks are most time-consuming? Where are errors common? Use tools and feedback from frontline staff to understand current workflows, targeting areas ripe for automation.

Assigning Stakeholders

Finance automation is a cross-departmental endeavor. Appoint a project lead to steer the initiative and ensure objectives are met. Involve members from key departments like IT, HR, and finance. Their combined input ensures the project meets the organization’s needs.

Setting Up Workflows

Plan the automated processes to require as little human input as possible. Focus not just on regular tasks like invoice generation but also on handling unexpected issues like discrepancies. The goal is to ensure a seamless flow, where tasks run smoothly and problems are solved efficiently.

Ultimately, a successful shift to finance automation depends on understanding current challenges, involving the right people, and meticulously planning for the future.

Benefits of Finance Automation

Finance automation offers businesses an advanced way to manage finances beyond traditional methods. Let’s look at the benefits this shift brings.

Increased Efficiency, Reduced Errors, & Consistency

Automating finance is like upgrading to a higher gear in a car. Processes that once took hours now take minutes. But speed isn’t the only perk. By eliminating manual interventions, you’re dramatically reducing the chances of human errors.

Moreover, automated systems are consistent. Whether it’s the first transaction of the day or the thousandth, the process remains uniform, ensuring standardization across the board.

Empowering Teams and Time Savings

Imagine your financial team, previously bogged down with data entry, suddenly having hours of free time. Automation frees them from routine tasks, paving the way for more meaningful work. They can now focus on analyzing data, making informed forecasts, or making strategies to improve profitability.

It’s not just about doing things faster but enabling your team to do more valuable work that capitalizes on their expertise.

Strategic Opportunities & Surfacing Insights

When automation handles the day-to-day, businesses gain the luxury of foresight. Financial teams can shift their focus from just reporting numbers to interpreting them. They can identify patterns, forecast trends, and suggest actionable insights.

Whether it’s identifying a new market opportunity or highlighting an underperforming product line, automation gives businesses data-driven insights, serving as a guide for strategic decision-making.

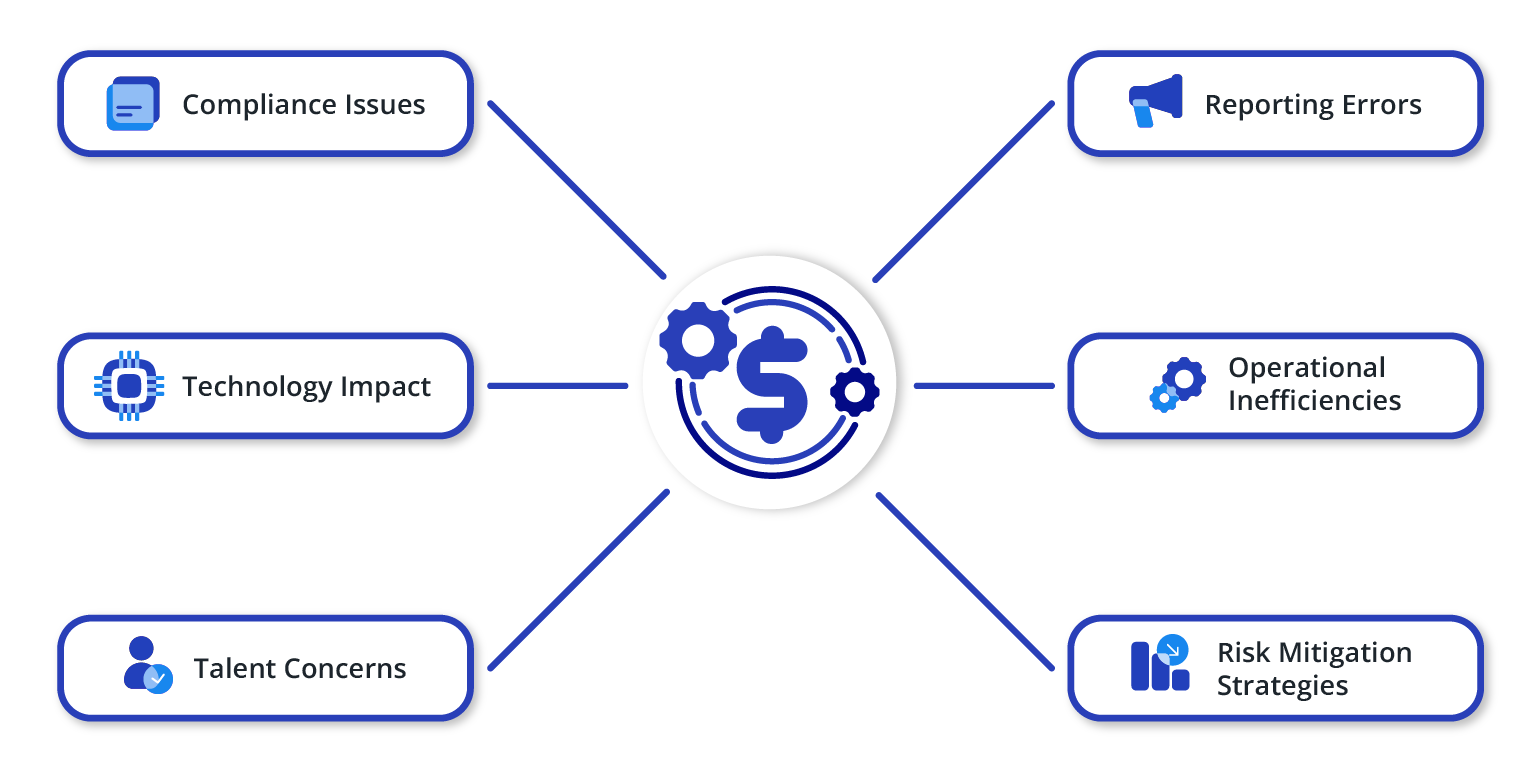

Risks and Challenges in Finance Automation

The transformative potential of finance automation is immense. But like any significant shift, it comes with challenges.

Compliance Issues

The world of finance is tightly bound by regulations, which constantly evolve. Automated systems must be regularly updated to stay compliant.

Whether they’re tax laws, international trade regulations, or industry-specific norms, ensuring that automated processes are compliant is non-negotiable. It requires vigilant monitoring and timely system updates to remain aligned with regulatory demands.

Technology Impact

Transitioning to an automated system often means investing in new hardware, integrating different software solutions, or ensuring robust cybersecurity measures. Training sessions might also be needed to familiarize the team with new tools, ensuring smooth adoption.

Talent Concerns

Employees might perceive business automation as a threat to their roles. Leaders should emphasize that automation isn’t about replacing but empowering. Workshops and training sessions can also show how these tools are meant to complement human skills, not substitute them.

Reporting Errors

While automation drastically reduces human errors, it isn’t immune to issues. Software glitches or system misconfigurations can lead to reporting inaccuracies. Regular audits, system health checks, and some manual oversight in critical areas can catch and fix such issues.

Operational Inefficiencies

Not all tasks are suited for automation, especially those needing human judgment. Businesses should carefully decide which processes to automate and which to retain in their manual or semi-automated form.

Risk Mitigation Strategies

The path to finance automation is strewn with challenges, but with the right strategies, they can be navigated effectively.

Maintain a robust backup system to safeguard against data losses. Regularly audit automated processes to detect anomalies early on. Keep abreast of technological advancements, ensuring your systems remain updated and compliant. With a proactive approach, the risks associated with finance automation can be minimized, letting businesses reap its numerous benefits.

Integration and Critical Features in Finance Automation

For seamless finance operations, integration is key. When considering finance automation, it’s important to see how the software fits your current setup and what features make it stand out.

Importance of Software Integration

In a company’s operations, finance is one of many components. While it plays a crucial role, it truly excels when it aligns with other departments.

Finance automation software should not only simplify financial tasks but also connect data from various systems.

Whether it’s the CRM software documenting client interactions, the HR system logging employee hours, or the inventory management tool tracking product movements, a good finance automation system integrates these data points. This seamless integration offers a comprehensive view, ensuring financial insights are grounded in real-time, cross-departmental data.

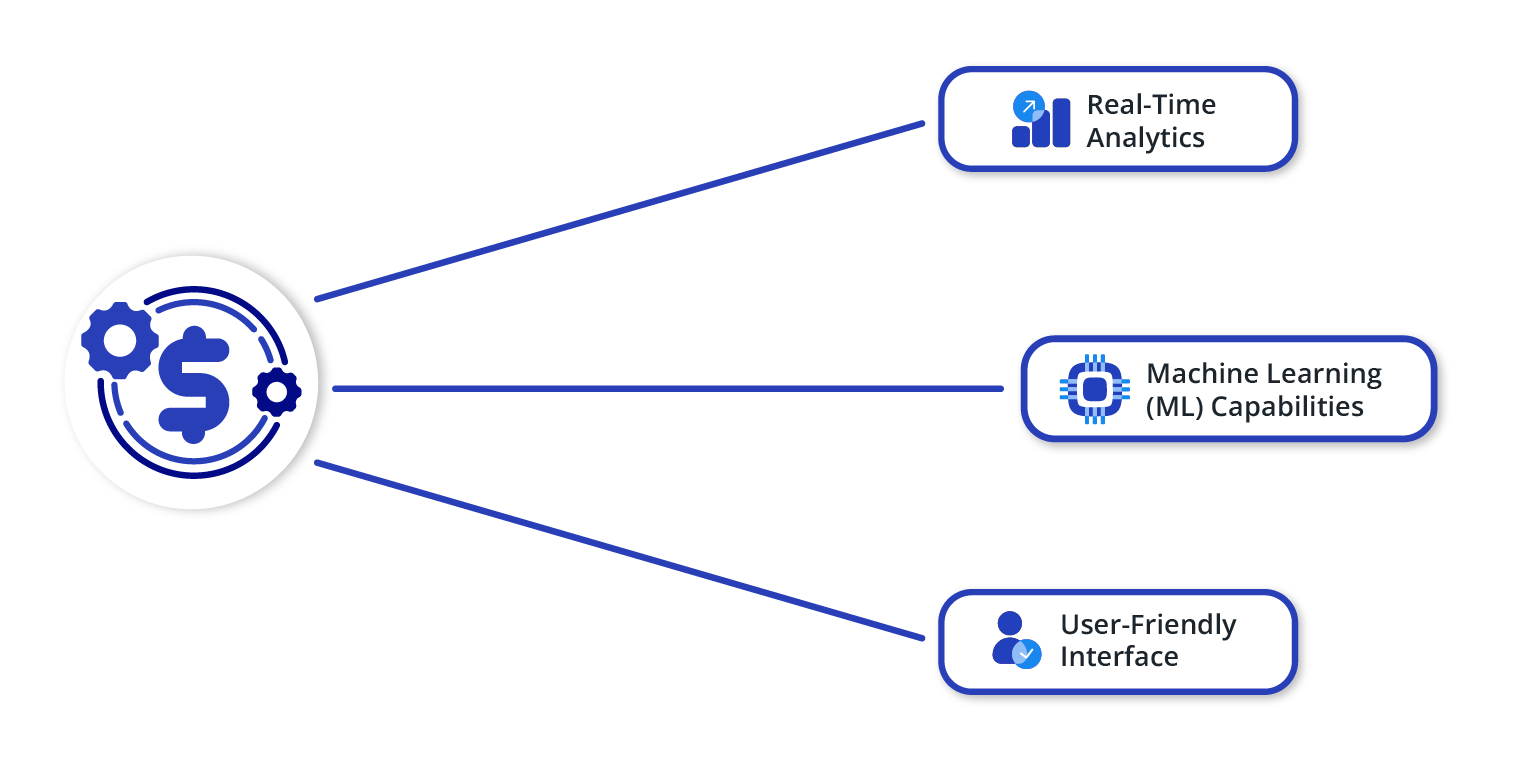

Key Features of Finance Automation Software

With the vast finance software options available, how can you spot the best? Here’s what you should be on the lookout for:

Machine Learning (ML) Capabilities

As we move into an era defined by data, having a system that learns, adapts, and evolves is vital. ML-equipped software can predict trends, identify anomalies, and offer data-driven insights tailored to your operations.

Real-Time Analytics

The pace of business today can’t afford delays. Your software should be capable of processing data in real-time, offering instant insights, and enabling quick decision-making.

User-Friendly Interface

A tool is only as good as its usability. Finance automation software should be intuitive, ensuring that users, tech-savvy or not, can navigate its features with ease.

Best Practices for Effective Integration

Merging a new system into your operations can be overwhelming, but with the right approach, it can be seamless. Here’s how:

Ensure Compatibility

Before adopting any tool, assess its compatibility with your existing systems. This will address integration issues and ensure data flows without bottlenecks.

Prioritize Data Security

Integration means data transfer between systems. Ensure robust cybersecurity measures are in place to protect sensitive financial data during this transfer.

Train Your Team

Knowledge empowers. Organize training sessions, webinars, or workshops to familiarize your team with the new tool. This boosts their confidence and helps them harness the software’s full potential.

The Future of Finance Automation: Is It for You?

As finance becomes increasingly complex and interconnected, leaders can’t afford to rely on dated, error-prone methods.

Finance automation is the solution. It not only streamlines tasks and reduces inefficiencies; it elevates your business to levels previously deemed unattainable.

With automation, you empower your team to shift their focus from routine tasks to strategies that foster growth. Beyond profit margins and balance sheets, this transformation also paves the way for more meaningful human experiences within the workplace.

For a forward-thinking leader like you, the decision isn’t whether to embrace finance automation, but when. Why wait for the future when it can be shaped today?

Dive into the world of finance automation with Kizen and shape the future of your business. Connect with us today.